How to Buy a Used Car on Installment: A Practical Guide

Introduction to Buying a Used Car on Installment

Purchasing a used car on installment is an attractive option for many individuals who want to balance their budget while acquiring a vehicle. This approach allows buyers to spread the cost over time, making it more manageable. However, navigating this process requires careful planning and understanding to ensure a successful purchase. This guide will walk you through the essential steps, considerations, and tips to help you make an informed decision.

Assessing Your Financial Situation

Before embarking on the journey of buying a used car on installment, it’s crucial to assess your financial situation. This involves understanding your budget, calculating monthly expenses, and determining how much you can comfortably allocate towards car payments. Considerations include:

- Monthly income and expenses: Ensure your car payment fits within your budget without straining other financial commitments.

- Credit score: A good credit score can offer better financing terms and interest rates.

- Down payment: A larger down payment can reduce the loan amount and monthly installments.

By evaluating these factors, you can set realistic expectations and avoid overextending your finances.

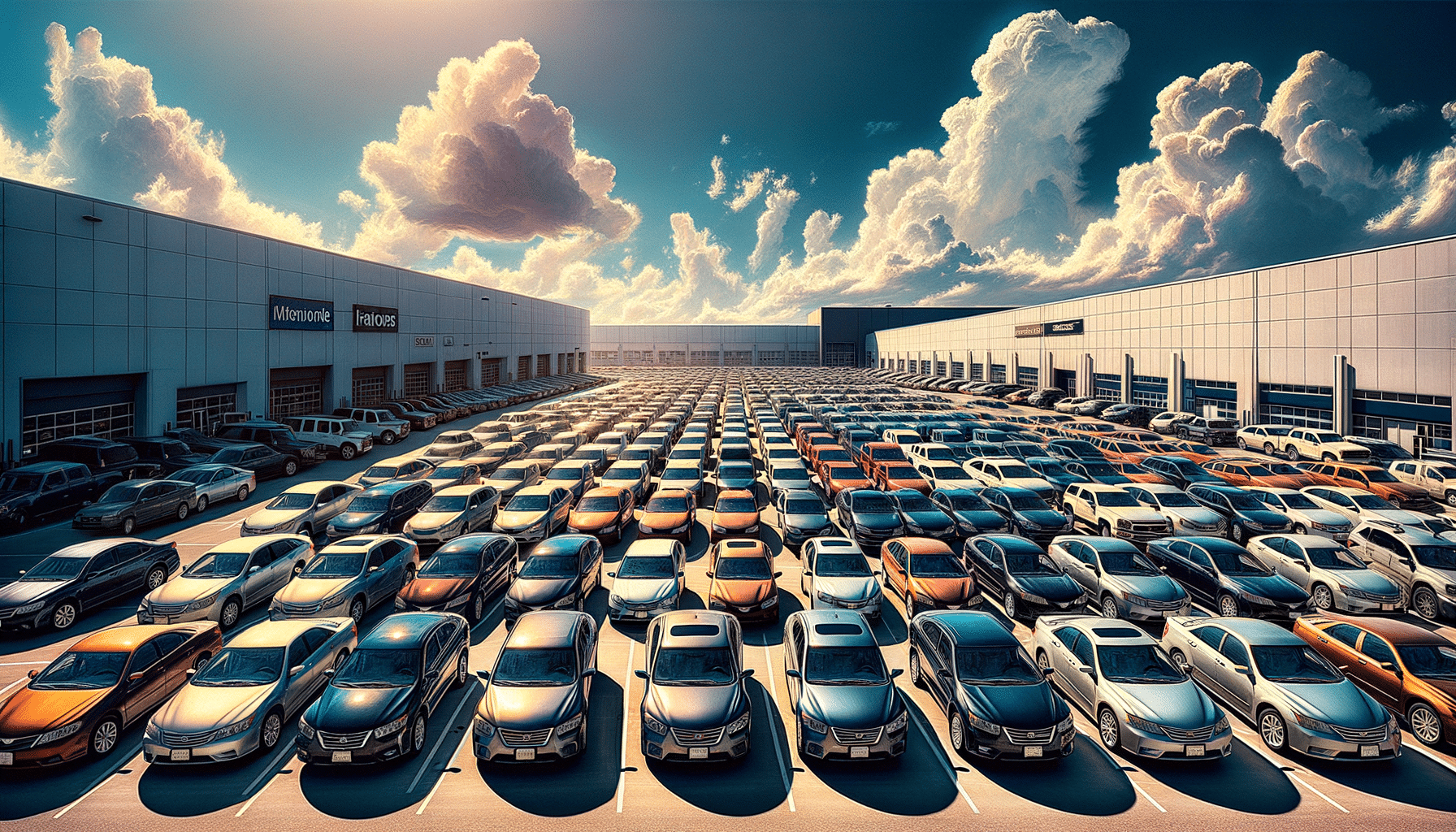

Researching the Right Vehicle

Choosing the right used car involves thorough research to find a vehicle that meets your needs and budget. Start by identifying the type of car that suits your lifestyle, whether it’s a compact car, sedan, SUV, or truck. Consider the following when researching:

- Reliability and maintenance costs: Look for models known for their durability and low maintenance expenses.

- Fuel efficiency: A fuel-efficient vehicle can save money in the long run.

- Resale value: Some cars retain their value better than others, which can be beneficial if you plan to sell in the future.

By focusing on these aspects, you can narrow down your options and make a well-informed decision.

Exploring Financing Options

Once you have a clear understanding of your financial capacity and the type of vehicle you want, the next step is exploring financing options. There are several avenues to consider when financing a used car:

- Bank loans: Traditional banks offer car loans with varying interest rates and terms.

- Credit unions: Often provide competitive rates and personalized service.

- Dealership financing: Convenient but may come with higher interest rates.

It’s essential to compare these options, considering factors such as interest rates, loan terms, and any additional fees. By doing so, you can choose the most suitable financing solution for your needs.

Finalizing the Purchase

With financing in place and a clear idea of the car you want, it’s time to finalize the purchase. This involves negotiating the price, reviewing the contract, and ensuring all paperwork is in order. Key steps include:

- Price negotiation: Use research on market values to negotiate a fair price.

- Contract review: Carefully read the contract to understand all terms and conditions.

- Inspection and test drive: Ensure the car is in good condition before committing.

By following these steps, you can confidently complete the purchase and drive away with your new vehicle.

Conclusion: Smart Buying on Installment

Buying a used car on installment can be a practical and financially sound decision when approached with careful planning and research. By assessing your financial situation, researching vehicles, exploring financing options, and finalizing the purchase with diligence, you can enjoy the benefits of your new car without financial strain. Remember, informed decisions lead to successful outcomes, making your car-buying journey a positive experience.